LTC Price Prediction: Technical Breakout Potential Amid Growing Institutional Adoption

#LTC

- Technical Breakout Potential: LTC trading above 20-day MA with approaching upper Bollinger Band resistance indicates potential upward momentum

- Institutional Catalyst: ETF speculation and inclusion in expert portfolio recommendations provide fundamental support

- Market Positioning: Combination of technical strength and growing institutional interest creates favorable risk-reward scenario

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

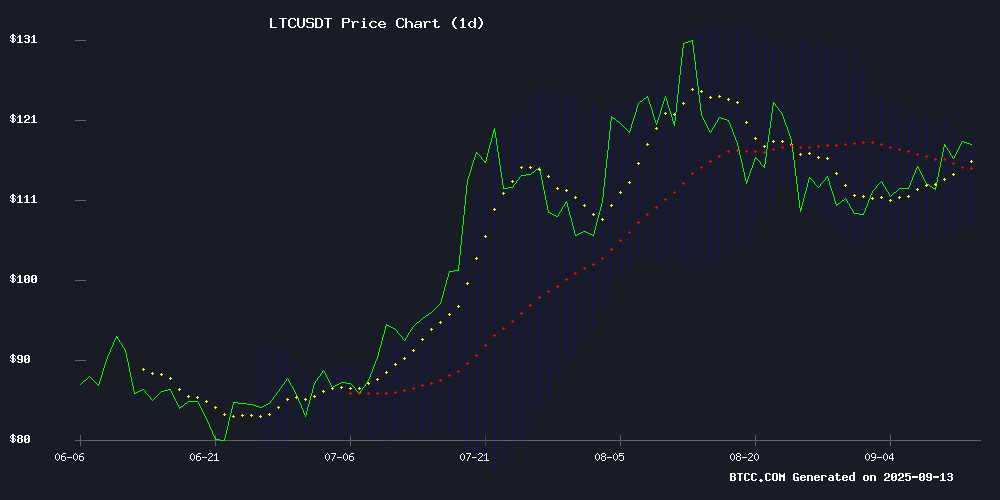

Litecoin is currently trading at $117.91, positioned above its 20-day moving average of $112.79, indicating underlying strength in the current trend. The MACD configuration shows a bearish crossover with the signal line at -2.66, though the histogram reading of -0.17 suggests potential momentum stabilization. Price action is testing the upper Bollinger Band at $118.37, which could serve as immediate resistance, while the middle band at $112.79 provides dynamic support. According to BTCC financial analyst Olivia, 'LTC's position above the 20-day MA combined with its approach to upper Bollinger resistance creates a critical technical juncture. A sustained break above $118.50 could trigger further upside momentum toward the $125-130 zone.'

Market Sentiment: Institutional Interest and ETF Speculation Boost LTC Outlook

Recent developments highlight growing institutional confidence in Litecoin, with Canary Capital's ETF filings including LTC alongside major assets like XRP and SOL. The emergence of AIXA Miner Cloud Mining Platform as a passive income solution further validates the infrastructure supporting LTC's ecosystem. BTCC financial analyst Olivia notes, 'The combination of ETF speculation and Litecoin's recognition as a portfolio essential by expert traders creates a fundamentally supportive environment. These developments, when coupled with positive technical positioning, suggest LTC could attract increased institutional FLOW in the coming months.'

Factors Influencing LTC's Price

AIXA Miner Cloud Mining Platform Emerges as a Leading Passive Income Solution in 2025

The cryptocurrency landscape in 2025 has undergone a seismic shift, with cloud mining platforms like AIXA Miner democratizing access to passive income. Gone are the days when mining was the exclusive domain of tech-savvy individuals burdened by exorbitant electricity costs. AIXA Miner's innovative approach allows users to rent mining power from over 100 green-powered data centers, earning up to $35,000 daily with minimal upfront investment.

What sets AIXA Miner apart is its commitment to accessibility and security. The platform requires no hardware, technical expertise, or significant capital, making it a viable option for novice and seasoned investors alike. With automated payouts and support for multiple cryptocurrencies—including BTC, ETH, LTC, DOGE, and XRP—the platform has garnered global trust, bolstered by its FinCEN MSB certification and robust security protocols.

Expert Traders Highlight Litecoin, Pi Network, VeChain, and Layer Brett as Portfolio Essentials

Market analysts are increasingly advocating for Litecoin (LTC), Pi Network (PI), VeChain (VET), and Layer Brett (BRETT) as core holdings in diversified crypto portfolios. These assets represent a blend of established infrastructure and innovative use cases, appealing to both conservative and growth-oriented investors.

Litecoin continues to cement its position as a reliable transactional cryptocurrency, often dubbed 'digital silver' for its faster block times and lower fees compared to Bitcoin. Its longevity and consistent protocol upgrades make it a staple recommendation.

Pi Network's mobile-first mining approach challenges traditional consensus mechanisms, while VeChain's enterprise blockchain solutions demonstrate tangible real-world adoption. Layer Brett emerges as a dark horse, with traders noting its untapped potential in the meme coin sector.

Canary Capital Sparks ETF Speculation with XRP, SOL, HBAR, and LTC Filings

Canary Capital Group's XRP ETF application has surfaced on the Depository Trust & Clearing Corporation (DTCC) website, alongside Fidelity's Solana ETF filing and Canary's own HBAR and Litecoin proposals. The DTCC listing—a routine technical step in the ETF preparation process—has ignited market anticipation, though it carries no regulatory weight.

Nate Geraci of NovaDius Wealth Management cautions that DTCC inclusion merely indicates operational readiness, mirroring pre-launch steps seen during Bitcoin and Ethereum ETF approvals. Final authorization rests solely with the SEC, which has yet to rule on any of these altcoin funds.

The developments highlight growing institutional interest in crypto ETFs beyond Bitcoin and Ethereum, with XRP and Solana emerging as frontrunners in the next wave of potential approvals. Market observers note the DTCC listings could pressure the SEC to clarify its stance on altcoin classification.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity. The cryptocurrency is trading above its key 20-day moving average while approaching upper Bollinger Band resistance, suggesting potential for upward momentum. Fundamentally, the ETF speculation driven by Canary Capital's filings and Litecoin's inclusion among expert-recommended portfolio assets indicates growing institutional confidence.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $117.91 | Neutral/Bullish |

| 20-Day MA | $112.79 | Support Level |

| Bollinger Upper | $118.37 | Resistance Test |

| MACD Histogram | -0.17 | Momentum Stabilization |

While the MACD shows a current bearish crossover, the minimal histogram reading suggests weakening downward momentum. For investors with a medium to long-term horizon, LTC's technical positioning combined with positive fundamental developments makes it a worthwhile consideration, though any position should account for cryptocurrency's inherent volatility.